Tax-efficient investing

Smart tax-efficient investment strategies

We all want to pay less tax, but that can be difficult when a significant portion of the tax we pay is a percentage of the income we earn and goods and services we buy.

When it comes to investing, however, the tax you pay varies by the type of return your investments generate. That’s why it’s important to invest strategically to reduce the tax you pay on your investment growth.

There are three broad categories of investment income, each with its own tax implications.

- Interest and other income

- Dividends

- Capital gains

The highest rate of tax is paid on interest income, which is the payment made to debtholders of a company, government or agency. Interest-bearing debt instruments include guaranteed investment certificates (GICs), bonds and money market funds. Foreign investment income is taxed similarly. Depending on the nature of the investment your principal may or may not be guaranteed.

Dividends are payments made by corporations for owning their shares. These payments, which are distributed by a company from its earnings, are taxed to the recipient at a lower rate than interest income. Dividends are not guaranteed by the company and neither is your principal.

Capital gains, which represent the difference in the amount you pay for equity ownership of a company and the price at which you sell that equity (assuming a positive return is generated from that equity ownership), are taxed at a lower rate than dividends and interest income.

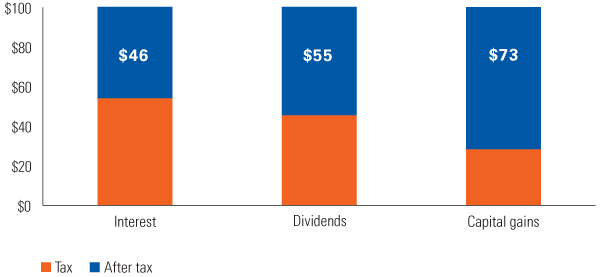

When your investment earns you $100, here’s what you’ll have after tax (assuming you’re in the highest tax bracket)

Source: www.ey.com. Combined top marginal tax rates for individuals in Ontario (2016) and rounded to the nearest dollar. See iA Clarington 2016 Tax Reference Sheet.

When investing in a registered account, such as a Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF) or Tax-Free Savings Account (TFSA), you don’t have to think too much about the nature of the returns you earn. Whether your investments generate interest, dividends or capital gains, none of these sources of investment growth are taxed when earned inside any of these accounts.

If you have maximized your contributions to your registered plans, or if you want additional flexibility in accessing your money, you may wish to invest in a non-registered account.

The tax you pay on the different types of investments shouldn’t be your only consideration. You want to ensure your portfolio of investments matches your time horizon and risk tolerance, and is designed to help you meet your short-term and long-term financial needs.

By reducing the tax you pay on your investments, you can save more over the longer term to help fund a more comfortable retirement, pay for a child’s education or purchase a house or car.

Corporate class

A corporate class mutual fund is part of a larger corporation that holds a number of individual funds. This structure can have attractive tax benefits.

Payout options

Series T versions of our funds provide regular, tax-efficient cash flow from your non-registered savings.

Tax-advantaged accounts

We offer RRSP, RESP, RRIF and TFSA accounts to help you achieve your financial goals in a tax-efficient way.

QROPS

A Qualifying Recognised Overseas Pension Scheme (QROPS) is a retirement savings plan that allows persons with eligible U.K. pensions to transfer their savings to Canada.