Registered Education Savings Plan (RESP)

Save money for your child's post-secondary education

What is an RESP?

An RESP is a special savings and investment account that helps you save money for your child's post-secondary education. The savings inside an RESP grow tax-free for the life of the plan. You may also qualify for government grants for your RESP.

How an RESP works

Opening an RESP: All you need is a Social Insurance Number (SIN) for yourself and your child. You can set up a family or individual plan.

Contributions: Anyone can contribute to an RESP — parents, guardians, grandparents, other relatives or friends. There is a lifetime maximum of $50,000 for each child named in an RESP.

Canada Education Savings Grant (CESG): As an incentive to help you save, the Government of Canada offers the Canada Education Savings Grant (CESG), which is 20% on the first $2,500 contributed to an RESP each year for an annual total of $500. The lifetime maximum amount per child is $7,200. Depending on your family's net income, you may be eligible to receive an enhanced CESG.

Canada Learning Bond (CLB): If you receive the National Child Benefit Supplement, you may also qualify for the CLB. If eligible, the Government of Canada will contribute a one-time payment of $500 to help you start saving early. If your child was born after December 31, 2003, you can get an additional $100 each year, up to a maximum of $2,000.

Provincial grants: Some provinces also offer education grants that can be used in your RESP. Check with your provincial government or talk to your advisor.

Withdrawals: Once your child is registered at an approved post-secondary institution, you can start making withdrawals from your RESP account. The contribution portion of the RESP is tax-free and there is no restriction on how these funds can be used. The CESG and accumulated earnings on all contributions are paid to the beneficiary as Educational Assistance Payments (EAPs). These funds must be used for education expenses and are considered taxable income for the beneficiary. But since your child is likely in a low tax bracket, any tax should be minimal.

Comparing RESPs to non-registered accounts

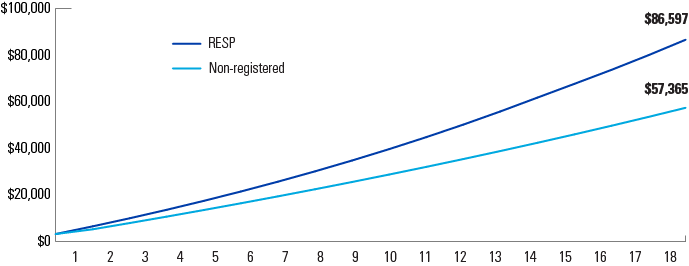

The chart below illustrates the potential benefits of using an RESP to save and invest for your child’s education.

RESP vs. non-registered investment account

Hypothetical example, for illustrative purposes only. After 18 years: Non-registered investment account, based on a $2,500 annual contribution for 18 years. Compound annual return of 5% taxed at 50%. RESP, based on a $3,000 initial investment ($2,500 personal and $500 CESG), a $2,500 annual contribution and a $500 CESG annual contribution. Compound annual return of 5% and growth is not taxed.